Editor’s Note

Remote work has made it normal for Indian talent to work for companies in the US, Europe, and the Middle East and for Indian startups to hire teammates anywhere on the planet.

But paying people across borders (and staying compliant) is messy: FEMA rules, TDS, social security, contractor vs employee classification… all the fun stuff.

That’s where Deel comes in.

Short answer: Yes, Deel operates legally in India, is used by thousands of companies worldwide, and offers multiple safe ways to receive and withdraw your money if you set it up correctly and choose the right withdrawal method.

Disclosure: This post contains affiliate links. If you book a demo using our link, we may earn a commission at no extra cost to you.

🎁 $500 credits are for eligible new customers and are Deel prepaid billing credits (terms apply).

👉 Claim your $500 Deel credits here

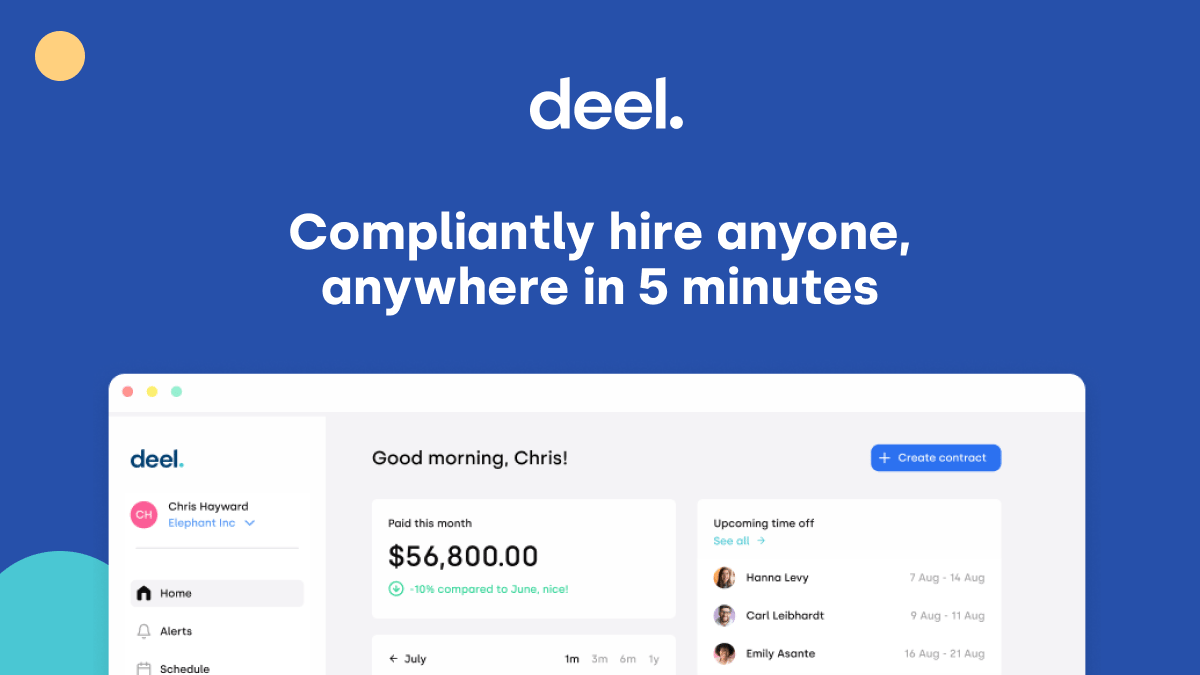

What does Deel actually do?

Deel is an all-in-one platform to hire, pay, and manage people in 150+ countries. It helps companies:

Hire full-time employees in other countries using Deel as an Employer of Record (EOR)

Pay contractors and freelancers globally

Run multi-country payroll through a single system

Manage HR basics (contracts, time off, documents, and more) in one platform

Instead of a company setting up its own legal entity in every country, Deel:

Either uses its own local entity (like its entity in India) to employ people on your behalf, or

Integrates with your existing legal entity and handles payroll/compliance

So if you’re:

An Indian freelancer/contractor working for a foreign client → Deel can be your payroll + payout layer.

An Indian startup hiring globally → Deel can handle payroll, contracts, and compliance.

A foreign company hiring in India → Deel can act as your Employer of Record so you can legally hire Indian employees without opening an Indian entity.

Is Deel legal in India?

Yes. Deel operates legally in India and supports hiring and paying workers here through its local infrastructure and partners.

A few key points:

Deel explicitly markets an Employer of Record (EOR) service in India, using its own local entity to employ people on behalf of global companies while ensuring compliance with Indian labour and tax laws.

It helps businesses handle India-specific requirements like local contracts, statutory deductions, and payroll compliance, instead of forcing clients to navigate local law alone.

Multiple media pieces from 2024–25 highlight Deel’s active expansion and footprint in India, including growth of its India team and support for businesses hiring in the country.

⚠️ Important: Deel is a compliant infrastructure provider, but it’s not a replacement for legal advice. If your use case is complex (e.g. ESOPs, secondments, or very senior hires), you should still speak to an Indian labour/tax lawyer.

For typical use cases like hiring remote employees in India through Deel’s EOR, or paying Indian contractors, Deel is designed to operate within Indian legal and regulatory frameworks.

Is Deel a startup?

Yes, Deel is still very much a startup in terms of growth, but at unicorn scale now.

Founded in 2019 and accelerated via Y Combinator.

Grew to tens of thousands of customers and 150+ countries within a few years.

Has raised multiple large funding rounds and is valued in the multi-billion-dollar range (around $17B as of its 2025 round).

So it’s no longer a tiny early-stage company, it’s a late-stage, high-growth HR tech startup.

Who is the CEO of Deel?

Photo by Stephen Phillips - Hostreviews.co.uk on Unsplash

The CEO of Deel is Alex Bouaziz, who is also one of the company’s co-founders.

He co-founded Deel in 2019 to solve a problem many global founders had: hiring and paying talent across borders without getting stuck in legal and payroll complexity.

Under his leadership, Deel:

Expanded to 150+ countries

Serves 35,000+ companies globally

Surpassed $1B in annual run rate revenue

Is Deel a safe platform?

Let’s break “safe” into a few angles:

1. Business & operational safety

Deel is used by tens of thousands of businesses globally, from startups to large enterprises.

It owns or partners with entities in 130–160+ countries to handle local payroll and compliance.

This scale doesn’t guarantee perfection, but it does indicate that a lot of legal, compliance and security work goes into keeping things stable.

2. Compliance & HR safety

Deel’s core product is global payroll and compliance, so the platform is built around:

Local-compliant contracts

Correct classification of workers (employee vs contractor)

Handling statutory taxes and contributions in each country

For companies, this is significantly safer than “just wiring money” and hoping everything is okay.

3. Data & payout safety

Deel highlights:

Advanced data security standards and certifications (including ISO/IEC 27001).

Trusted third-party providers for withdrawals (PayPal, Payoneer, Wise, Revolut, banks, crypto partners, etc.).

As with any large tech company, Deel has also been in the news for legal disputes (for example, with competitor Rippling over alleged corporate espionage). These are ongoing and contested cases, and Deel denies wrongdoing.

Practical view:

For most users, Indian freelancers, contractors, and companies, Deel is considered a reputable, enterprise-grade platform.

Still, never keep huge idle balances anywhere; withdraw into your preferred bank or wallet regularly.

How can I withdraw my money from Deel?

Supported withdrawal methods (in general)

Deel supports several withdrawal options, including:

Local bank transfer

Deel Card / Instant card transfer (prepaid Mastercard)

Wise (especially common for India)

PayPal

Payoneer

Revolut

Coinbase / Digital currency transfer (USDC/USDT in eligible countries)

Availability depends on your country and currency, so always check the latest options inside your Deel account.

Step-by-step: How to withdraw from Deel (typical flow)

For independent contractors, the flow usually looks like this:

Verify your account

Your contractor account must be verified before you can withdraw.

Add a withdrawal method

Log into Deel

Go to Account Settings → Withdrawal Methods → Add Method

Choose your method (e.g. bank transfer, Wise, PayPal, etc.)

Enter the required details and save.

Start a withdrawal

From the Home page, check your Deel balance.

Click Withdraw.

Enter the amount you want to withdraw.

Select your preferred withdrawal method.

Confirm.

Track your payout

Deel will show a dynamic ETA and status updates via the Withdrawal Tracker.

💡 For India specifically:

Many users like routing Deel → Wise → local Indian bank account because Wise often gives good FX rates and a predictable experience.

Always keep an eye on:

Minimum withdrawal amounts

Platform fees + any extra bank/provider fees

These vary by method and country.

Why use Deel in India?

If you’re an Indian freelancer or contractor

Deel can help you:

Get paid in foreign currencies by global clients

Avoid spending hours chasing invoices and payment links

Withdraw to multiple methods (bank, Wise, PayPal, etc.)

Get contracts that look professional and compliant

This can make you feel more “enterprise-ready” when working with international clients.

If you’re an Indian startup or HR leader

Deel can help you:

Hire talent in other countries without opening entities everywhere

Pay employees and contractors in their local currency

Stay compliant with local payroll/tax rules

Manage everything from one dashboard

For a lean HR team, that’s a big leverage boost.

If you’re a foreign company hiring in India

Instead of spending months and lakhs of rupees setting up an Indian entity, you can:

Use Deel’s Employer of Record to hire Indian employees

Have Deel handle local contracts, payroll, PF, and statutory obligations

Scale hiring up or down more flexibly, especially in early stages

Pros and cons of using Deel (honest take)

Pros

✅ Global reach: 150+ countries, including a strong presence in India

✅ Legal + compliance layer: EOR + global payroll + HR, not just payments

✅ Multiple withdrawal methods (great for Indian talent)

✅ Enterprise-grade platform with big-name customers and strong growth

✅ Ideal for distributed teams and remote-first companies

Cons

❌ Not the cheapest option if you only want occasional small transfers

❌ Interface and compliance rules can feel complex if you’re brand new to global hiring

❌ Some withdrawal options come with third-party fees (banks, PayPal, etc.)

❌ Like any big startup, it’s involved in legal disputes, which some buyers may want to track

Ready to try Deel? Grab $500 in credits

Photo by Artem Beliaikin on Unsplash

If you’re planning to:

Hire in India or from India

Pay Indian or global contractors

Or finally clean up your messy multi-country payroll…

…then it’s a good time to test Deel while they’re offering credits.

👉 🎁 Get $500 in Deel credits with this link (for new users only)

Quick FAQ: People Also Ask about Deel

Is Deel legal in India?

Yes, Deel operates legally in India. It uses its own local entity and partners to act as an Employer of Record and payroll provider, helping companies comply with Indian labour, tax, and payroll laws when hiring here. For complex edge cases, always check with a legal or tax advisor.

What does Deel do?

Deel is a global HR, payroll, and compliance platform. It lets companies hire and pay employees and contractors in 150+ countries, manage contracts and HR workflows, and stay compliant with local laws, all from one dashboard.

Is Deel a startup?

Yes. Deel is a high-growth HR tech startup founded in 2019, backed by major investors, and valued in the multi-billion-dollar range. It has grown from a YC startup to a global unicorn serving tens of thousands of customers.

Who is the CEO of Deel?

Alex Bouaziz is the CEO and co-founder of Deel. He launched the company in 2019 to make it easier for businesses to hire and pay global teams, and has since led its growth into a leading global payroll and compliance platform.

Is Deel a safe platform?

Deel is generally considered a safe and reputable platform used by thousands of companies worldwide. It focuses on compliance, holds multiple security certifications, and offers trusted payout partners. As always, users should withdraw funds regularly and review fees and limits for their specific country and withdrawal method.

How can I withdraw my money from Deel?

To withdraw money from Deel, you verify your account, add a withdrawal method, and then move funds from your Deel balance to that method. Supported methods include bank transfer, Deel Card, Wise (popular in India), PayPal, Payoneer, Revolut, and sometimes digital currency transfers like USDC/USDT, depending on your country.

Get Great Deals from our Affiliate Partners

Zoho People: an online HR software solution designed to manage all your HR processes seamlessly. ($100 credits). Use this link to avail the offer: https://go.zoho.com/Pod

TalentLMS: a simple, HR-friendly LMS trusted by companies like Nokia, Amazon, LG, and UnitedHealth Group.

Zoho Recruit: A cloud-based hiring platform that gives HR teams and recruitment agencies the digital tools needed to fill roles quickly and efficiently. ($100 credits). Use this link to avail the offer: https://go.zoho.com/Aea

Make: Automate your daily tasks across apps with Make — no code, just drag & drop magic.

Apollo: The AI sales platform for smarter, faster revenue growth

Manychat: Automate your conversations with Manychat. Build chatbots for WhatsApp, Instagram, or Facebook and turn messages into conversions.

Typeform: Build beautiful forms, surveys, and quizzes with Typeform — it’s what we use and love!

Lovable: Create Apps & websites by chatting with AI

Dub: Create short links, run affiliate programs, and track conversions

Eleven Labs: Create realistic and natural-sounding AI-generated speech and audio